There are startling differences in the regional prices of gas in the period 2010 to July 2014. Henry Hub prices in the USA were very low in comparison with Europe. The rapidly developing Liquefied Natural Gas (LNG) trade brought new supplies to Europe and the softening of oil prices at the end of 2014 brought about a convergence.

We in Ireland pay at least the UK wholesale market price, an exit charge from the UK system plus the entry cost to the Irish transmission system at Moffat in Scotland. The additional costs that arise for consumers in the UK and in Ireland are those to pay for the national gas transmission and distribution systems. The final price we pay includes a supplier margin that is determined by competition between gas suppliers.

Thus, as consumers we have an interest in the regulation of the gas market, the level of investment in infrastructure allowed by the CER, and the assurance that supplier competition is real and effective.

Finally, because most gas imported into Ireland is used for electricity generation we have an interest in how Irish energy policy affects the demand for gas in electricity. As the demand for gas for electricity falls the cost of the existing infrastructure is carried by a lesser amount of gas and the unit cost of delivered gas has to rise.

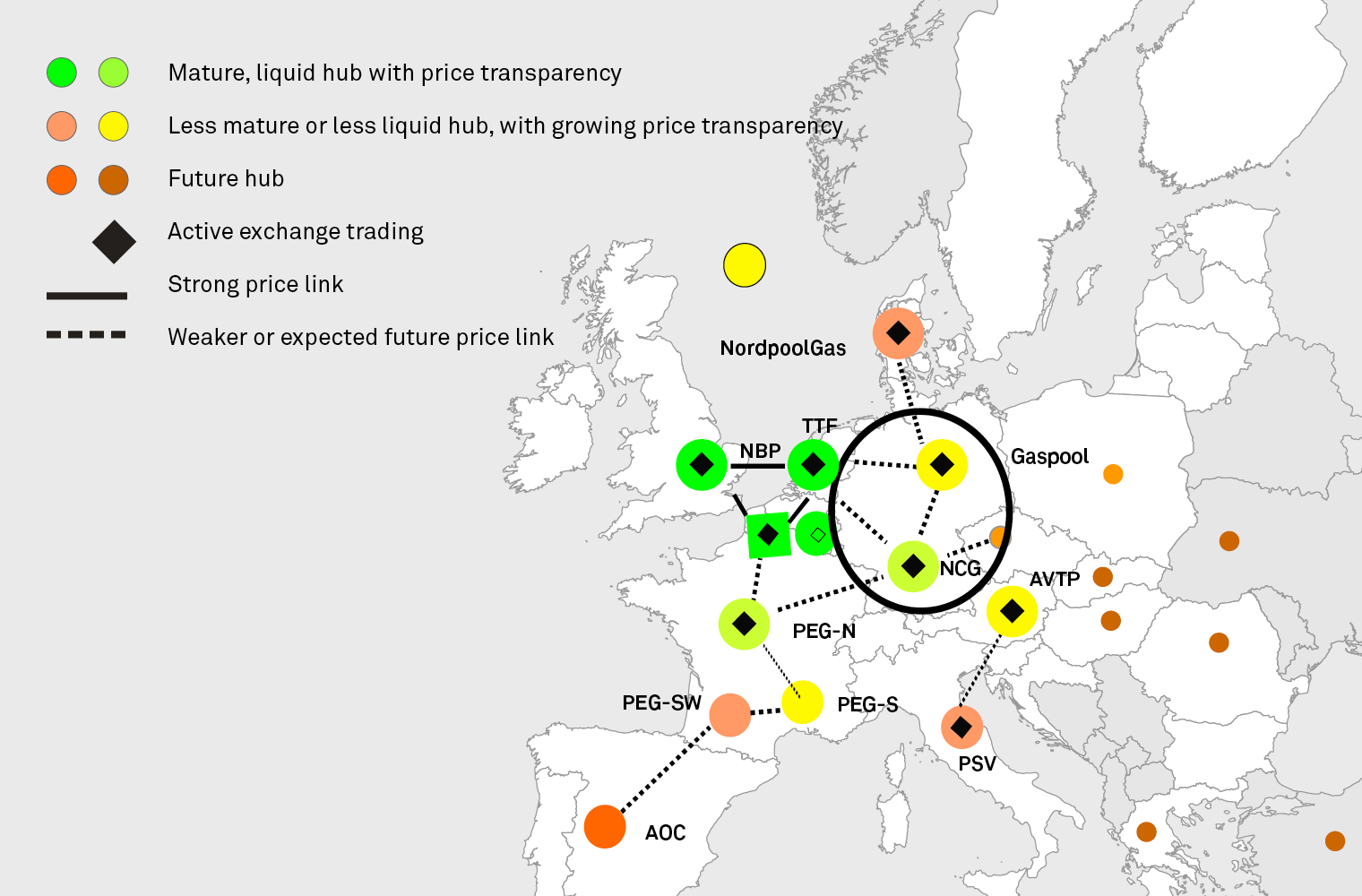

There are gas-trading points and trading hubs in Europe; the most important of these are the Dutch TTF (Title Transfer Facility), the National Balancing Point (NBP) in the UK and the German hubs (Fig. 6). Until Corrib came on stream we imported up to 96% of our gas from the UK and our prices are closely coupled to the UK NBP price.

With the growing use of natural gas in the 1960’s and onwards, in many cases it was in the producer country’s interest for gas prices to be referenced to oil prices. This was certainly the case for Russian gas where, until 2011, German BAFA prices closely followed an oil-linked formula. After a short transition BAFA prices in 2013 moved closer to the Dutch TTF, at which Dutch and Norwegian imports are priced. The EU favours the further development of gas trading hubs in Europe .