Where does Ireland’s gas come from and what determines its price?

For the first time since the late 1990’s we are in a position to meet 58% of our gas needs from indigenous resources at Corrib and Kinsale. The balance of our natural gas requirement is imported from Britain and the price of gas on the Irish market is determined by the marginal cost of this imported gas. Ireland’s gas market is closely linked to the UK market.

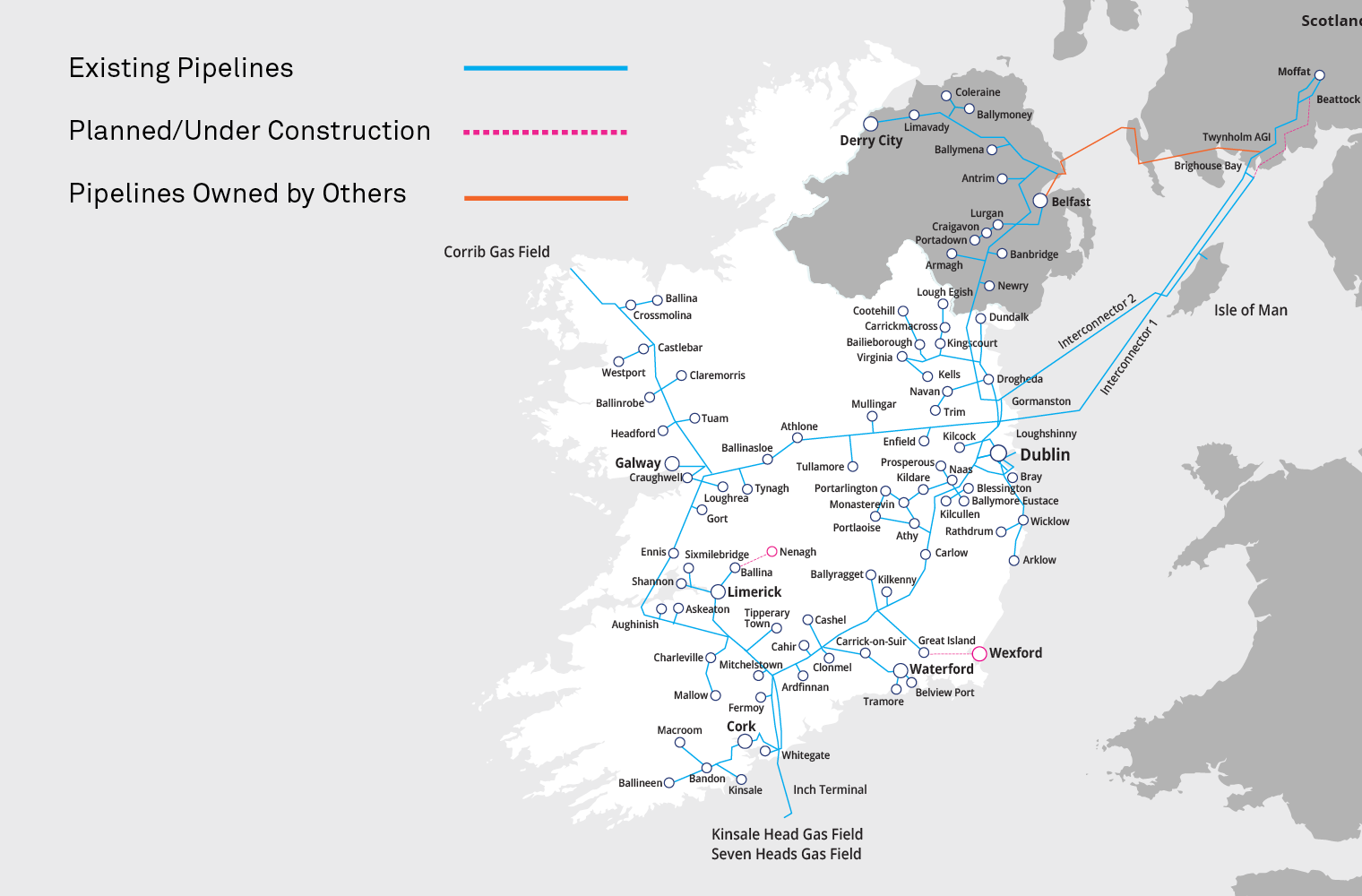

Until Corrib gas started to flow in December 2015 we imported 96% of our gas from Britain via a system of sub-sea pipelines from Scotland 1. Thus the price we pay for our gas as a commodity is set by the price of natural gas at the UK gas trading hub, plus the cost of transporting it to Ireland via the subsea interconnectors. The UK’s natural gas trading hub is known as the National Balancing Point (NBP).

Britain has four main sources of gas – its own offshore UK North Sea natural gas (35%), Norwegian North Sea natural gas (38%), Continental natural gas (15%) 2 and imported liquefied natural gas or LNG (12%) 3. LNG usage is growing in Europe and is imported by tanker from many places in the world.

The island of Ireland taps into that diverse and secure supply with three undersea pipelines that connect directly to the British gas system at Moffat in Scotland. (Fig.1).