Where does our oil supply come from? How is it imported or moved around the country?

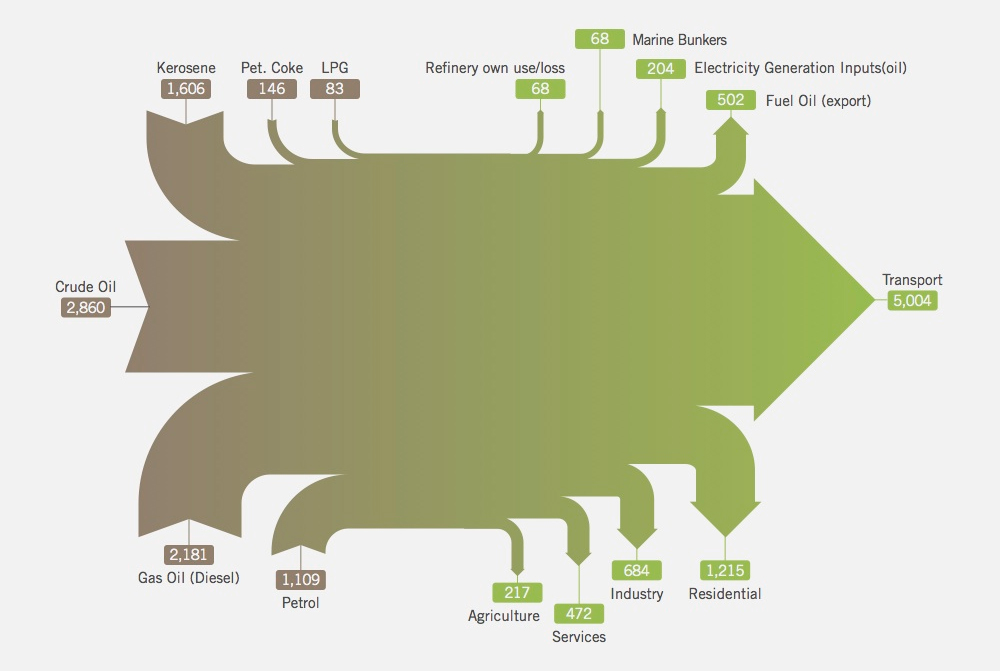

The sources of our refined petroleum products in 2014 are illustrated in the pie chart below (Figure 5). Most of the crude oil imports were from Norway and the UK, but some came from North and West-African countries. Refined product arriving through import facilities or from the Whitegate refinery is distributed to regional depots and retail stations throughout the country. In 2014 oil accounted for 56% of Ireland’s fossil fuel imports. Almost one third of this was in the form of crude oil for refining. The balance was in the form of refined products, mostly petrol, diesel, and jet fuel. We have the fourth highest oil dependency in the EU 1.